Over 20 years in business - Discover Rare Treasures & More!

20% off Your First Order!

Discover a premier selection of coin show buys, currency, cards, and more! Shop with the best!

New Items

103

Add to Watchlist

Add to Watchlist

56

Add to Watchlist

Add to Watchlist

VERY CIRCULATED VINTAGE BUFFALO NICKEL 1929-D BUFFALO NICKEL.

$19.00

Add to Watchlist

Add to Watchlist

Immanuel Kant .999 1/2 Ounce of Silver German Commemorative Pure Silver Coin!

$85.00

Add to Watchlist

Add to Watchlist

181

Add to Watchlist

Add to Watchlist

Jay's Special Deals!

1942-P LINCOLN WHEAT CENT PCGS MS66 RED/RD OLD GREEN HOLDER (LATEST) BEAUTY

$107.00

Add to Watchlist

Add to Watchlist

96

Add to Watchlist

Add to Watchlist

202

Add to Watchlist

Add to Watchlist

217

Add to Watchlist

Add to Watchlist

1939 Mercury Dime BU Uncirculated Coin Beautiful Colorful Rim Toning

$150.00

Add to Watchlist

Add to Watchlist

227

Add to Watchlist

Add to Watchlist

Bullion (Free Shipping)

204

Add to Watchlist

Add to Watchlist

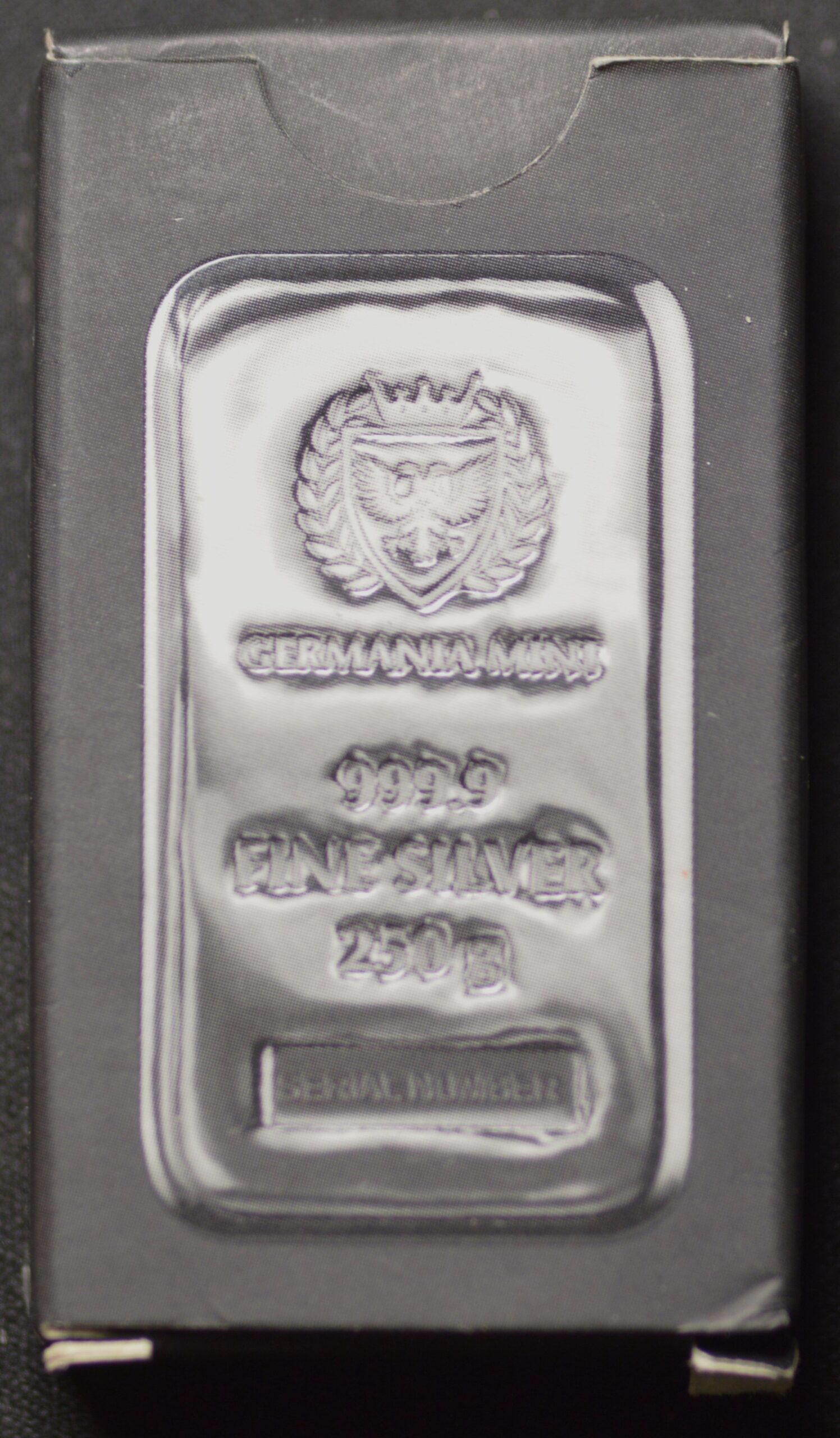

Germania Mint 10 oz Silver .999 Fine Bar Straight from Germany!

$599.00

Add to Watchlist

Add to Watchlist

202

Add to Watchlist

Add to Watchlist

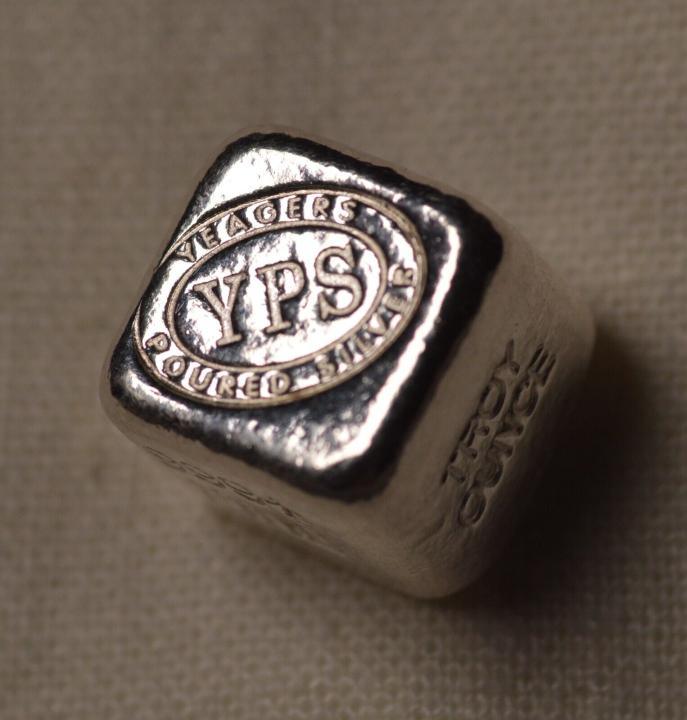

MR HEAD OF SKULL 1.75 OUNCE OF .999 FINE PURE SILVER MK BARZ !

$375.00

Add to Watchlist

Add to Watchlist

Customer Feedback

Hey man I really appreciate the bar and Great communication and awesome packaging look forward to more deals.

His selection of German coins especially the Max Planck coins were phenomenal.

Columbian was in Good condition, Satisfied Customer...

Great Coin seller, Great Seller Easy to work with, Highly Recommend!

My take, gold and silver are the only recognizable assets that you can use to buy a piece of bread. They always will have value and are a great investment for the future. Precious metals like gold and silver will always be available that is why California Coins is where I buy my gold and silver at.

Glad you're back! Got that toned merc dime off you. Will be back for more. Great dealer.

He threw in a free coin! How cool!

Great service. Great Buffalo Nickel. Definitely undergraded and seller made a good deal to make it work!

Previous

Next